The COVID-19 blog for Economic and Trade Promotion Organisations

Business decisions and government priorities need to be completely rewritten in the coming months.

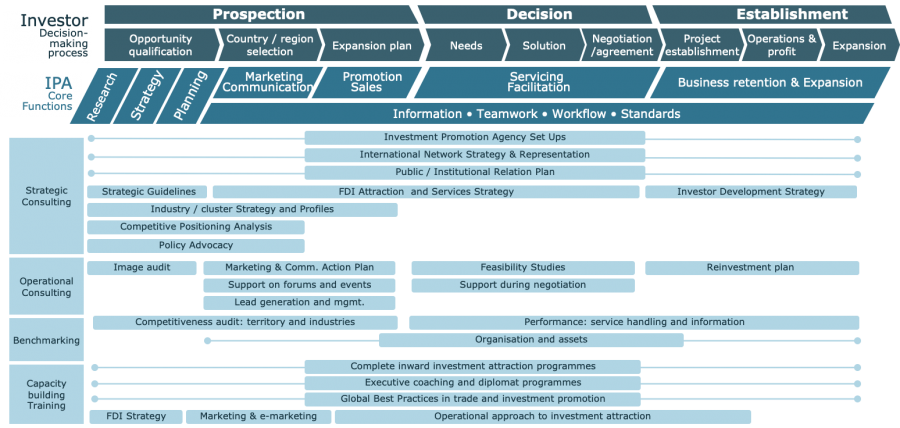

As a leading, specialised foreign direct investment and trade promotion consultancy GDP Global offers this assessment of the impact of Covid 19. It’s coupled with a nine-point plan for investment promotion agencies (IPAs), trade promotion organisations (TPOs) and related government departments, on how to respond to the economic challenges posed by the pandemic today and through to 2022.

First in Asia, then Europe and North America, and now in Southern Africa, Latin America, and Australia, Covid 19 has spread relentlessly, infecting 20 million people worldwide as of the second week of August. Governments have been forced to take previously unimaginable decisions to control the impact on their people and health services and limit the resulting economic damage. In Europe, there are signs of a second spike after a cautious emergence from lockdown; in other parts of the world, the pandemic has yet to peak. In most places, normal life is on hold, pending the development of a safe and effective vaccine that is available to all.

So, what is the latest situation regarding the global economy, global business, FDI and trade? More importantly, what should we do as economic promoters!

Global Business, FDI and Trade

Let’s take a look at the impact on the global economy, global trade and foreign direct investment. Global growth decelerated to an estimated 2.4 per cent in 2019, the slowest pace since the global financial crisis. This was forecast by the World Bank to improve gradually to 2.7 per cent by 2022.

Global Economic Impacts

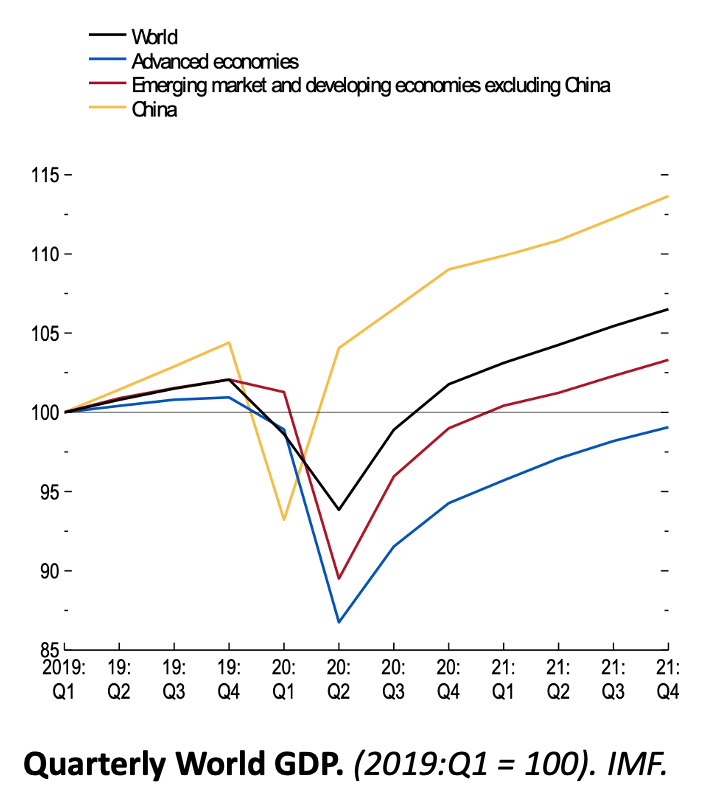

As of end of June 2020, and even in late August, we all can sense the devastating impact of COVID in our lives and economies. The IMF indicated (Figure 1) their view of just how dramatic the economic impact had been amongst major economic groups. Advanced economies stalling almost in Q2, by 25% over Q1. All economies affected. Furthermore, they gave their best estimates for what the near future would look like. It will be at least till the end of 2021 before all economies return to 2019 levels of GDP.

The impact of this pandemic is going to be felt globally right through to the end of the year. The IMF projects that the global economy will contract sharply by –3 per cent in 2020, which is much worse than during the 2008–09 financial crisis. Assuming that the pandemic fades in the second half of 2020 the global economy is projected to grow by 5.8 per cent in 2021 as economic activity normalizes, helped by policy stimulus packages in key markets.

At this time, such a prompt bounce back is in our opinion, highly unlikely. We fully expect that the globalised economies will continue to deteriorate in Q3 and Q4. A positive picture of something near normal – perhaps from Q1 2021, will be offset by major unemployment and a continues paralysis of global travel and trade.

This time too will start to place stresses in sovereign confidence. The heavily indebted countries – those with greater than 80% debt to GDP ratios, will be wondering how to restructure their public economies over the next 10 years. Other economies will already be seeking bailouts and pledges for support from international and regional financial organisations such as the IMF and the ECB. Countries with high debt levels, poor governance, even political instability, will see their costs of borrowing spiral upwards and their reputations leading to a slide in country ratings. Will these economies still be attractive to foreign investors?

We estimate that global trade is set for a decline of around 11% in 2020, and a rebound of 8.4% in 2021. We can expect to see a rise in global political tensions, as the United States and China intensify their struggle for hegemony. European and other countries will be encouraged to take sides.

The Response by Multinational Businesses

It’s our sad conclusion that jobs and livelihoods will be affected, even for those who stay in work. Many sectors face heavy scarring and, of course, many businesses face extinction. This is especially true of the aviation and international travel sectors, and the tourism economy around the world. Stock markets will see huge corporate losses, similar to or bigger than the 1999 and 2008 crises.

Several countries will be regarded as too risky for market-driven, manufacturing led FDI. Resources investments are also unlikely to grow, given the likely depressed demand for industrial commodities. Paradoxically, a significant skills shortage, amongst other necessities, will stimulate business process re-engineering leading to more manufacturing automation, and more job losses as a consequence.

So, with global economies in sharp recession and global trade paralysed till Q3/4, the prospects for FDI are also dire. FDI flows will be negative in all economies as investors put their plans on ice as the inherent risks of globalisation and global value chains become reality. UNCTAD forecasts FDI flows could decline between 30% and 40% during 2020-2021. GDP expects that whilst there will be some new FDI it follows that there will be significant downsizing or even closure foreign plants around the world.

Losers and Survivors in the Global Economy

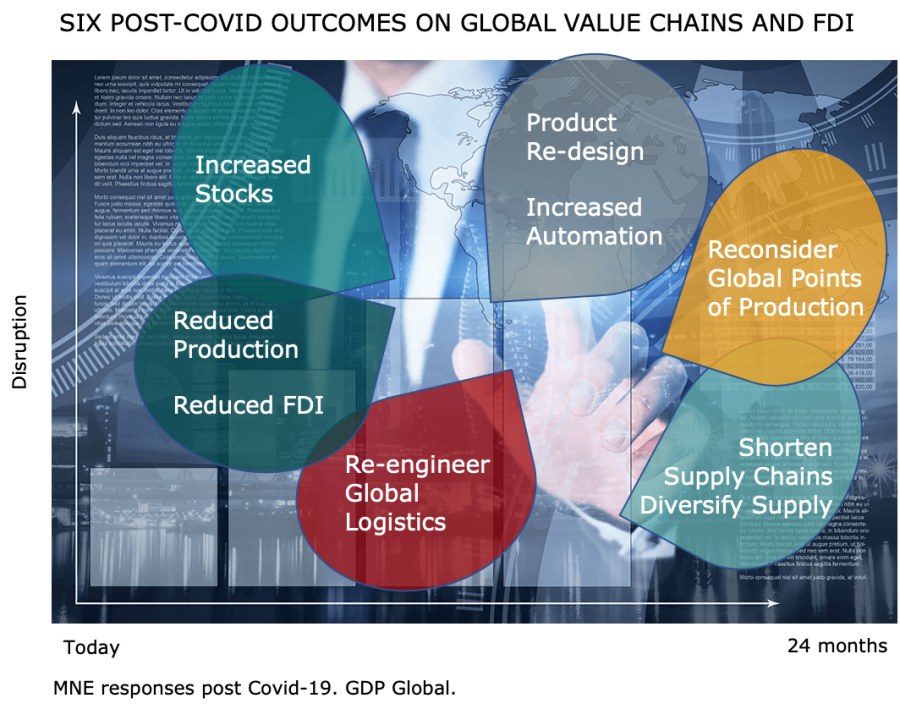

Governments and international businesses will, in all likelihood, seek to recalibrate their exposure. The public debate is ugly at times, but the discussion will determine a new shape for globalisation going forward. This globalisation tension, combined with a decline in global demand of many products and services, at least in the short term, will force international businesses to review their global value and supply chains.

Companies that operate critical supply chains for so-called just in time manufacturing, will inevitably re-shape their global value chains, perhaps being lured with inducements to re-shore business activities to reduce dependence on foreign markets, especially China. The automotive sector is a classic example of manufacturing that has been adversely affected by this disruption. Similarly, those companies that rely heavily on just one or two sources of supply, for example, speciality chemical and biochemical products for pharma and healthcare companies, will most likely rethink how to reduce risk in the light of such possible disruptions in the future. Companies are also likely to redesign their products and processes by introducing yet more automation, with a downside for employment manufacturing, whilst reorganising their knowledge workers to work more from home.

Whilst many businesses will succumb, other businesses will respond, taking the opportunity to accelerate organisational change, transforming towards more investment in technology and automation, most likely focusing on the quality of skills rather than numbers of workers. Foreign investor disinvestments, facility shutdowns, job layoffs, so-called rightsizing, will create painful unemployment at a local level. This trend will be with us for the next 12-18 months and will lead to a permanent and fundamental shift in doing business, through the adoption of AI, less overall employment, and more jobs for knowledge workers.

Economic Promoters – Let’s Consider your Options

There are no winning locations at the moment, though some locations will not experience too much difference. Many countries and regions are exposed, however. They stand to see their international business base heavily affected, which will in some cases have a deep and lasting impact on local economies, local employment and local suppliers.

Having listened to many governments and businesses, and a wide range of views from experts and observers, what can government economic and trade promoters expect to be the implications for their economies in the immediate and longer-term and how should they respond? Here is our advice to governments and especially to their economic, investment and trade promotion organisations for action, both now today – whilst still in lockdown, and in the coming months.

Nine Point Plan for Economic Promoters

1. Take Stock of your Investors. Research, Company surveys; Business Retention and Expansion (BRE). Get in contact with your existing business and investor base, whether local or international in origin. Find out how they are thinking. Understand the issues they and their industries are facing; is it a partial or total drop in demand for their products and services (in many cases their business will have dried up completely); is it business disruption they are facing in terms of international and local product supply, as well as global logistics; financing matters.

2. New Plans – Business Planning Make sense of the feedback in terms of the economic impact in the immediate term (three-six months), short term (6-12 months). Yes, at a time of crisis, timescales are further compressed. Group companies according to their challenges, especially with respect to their most important customers (20% of their customers will typically account for 80% of their business), their export customers, likely skills and supply shortages, and especially their finance/cash flow challenges. Christina Knutsson, director and leading FDI specialist at GDP Global, says that from this analysis, determine those businesses which have the greatest value to your region in the medium and longer-term (next three years) and that can be supported by you. You will have to make tough choices. Picture recent TV news when doctors classified patients on or off respirators. Focus on companies that really matter to your economy. For others, direct them to other groups that may be able to help, e.g. local authorities, chambers of commerce, business advisers, accountancy firms, banks, national finance intermediaries, even insolvency specialists.

3. Reorganise for BRE Take bold steps with your economic promotion agency. For example, triple the number of staff and consultants that will focus on BRE.

John Hanna, MD at GDP Global, has worked through at least three major international recessions since 2000. His advice is to set up in task forces, each with clear objectives and targets, that will focus to deliver, day by day, support packages of business services and financial services, in order to keep their operations running through the difficult months ahead. “Cash is King” for businesses. So, work closely with banks and public sector lenders to ensure they are easing and facilitating finance where possible. Where local taxes and business rates apply, VAT collections, corporation tax payments, even social taxes are due, work with the company and the authorities to permit payment deferrals/holidays that your companies can benefit from. The same goes for commercial and industrial landlords and utility companies – encourage them to support their existing tenants through the coming months with deferred lease and rental charges.

Implement 12 month and two-year transformation plans as quickly as possible between your agency and its most important companies. Agree what support your agency task forces can organise and provide and what the companies, in turn, will do to maintain jobs, invest in new facilities, new products and seek new export markets where appropriate.

Focus on sustainable FDI. Don’t apply all your agency efforts for companies simply to survive today. Help companies to transform. On the positive side, this will mean encouraging companies to re-invest. It may mean companies having to downsize, but this is worth supporting if it means companies will stand a better chance of surviving.

4. Rebuild the FDI Project Pipeline.

No matter how good your investment project pipeline was pre-COVID-19, says Paul Whiteway, director at GDP Global with a focus on business development, says that you should assume that it is now defunct.

Most FDI projects will either be under significant review, on hold or completely scrapped.

At the same time, given some patience and persistence, there is every chance to focus on new investment opportunities and to put your case in front of the investors.

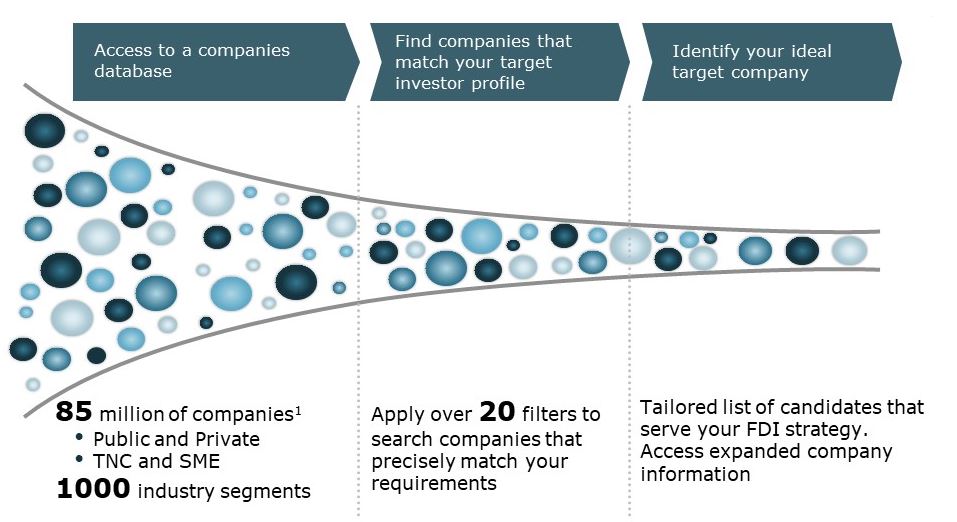

The targets for sector investments depend on the new FDI strategy you wish to pursue as well as the depth of promotion you are undertaking. Remember this is a numbers game; it’s good to have competence in data mining, investment targeting, FDI intelligence resources as well as a high degree of persistence.

5. Rebuild the Trade Leads Database. Use global import-export market intelligence to focus on international marketing and sales. Many of your businesses will be export-driven. Export market intelligence is key for the companies but also vital for your broader economy in that it drives foreign revenues that support the balance of payments. You may find that your currency has taken a hit compared with other economies. Use the new-found financial advantage of more competitively priced export products to businesses to seek export markets and customers. Your trade promotion agency or division will be a vital beacon in identifying emergent export opportunities. Get close to your biggest exporters as well as the export the councils and trade bodies. See what they need and be as supportive as possible. Doing this will help them to secure opportunities for new trade leads as well as, of course, creating jobs and export revenues for your economy. Don’t delay!

6. Trade Development Programmes. Your trade promotion agency or division will also be vital in providing assistance to companies to ramp up their export capabilities. Help companies and exporter groups (export councils) in important business areas such as:

- Understanding and joining global value chains

- Preparing for international supply chain and purchasing standards

- How to finance their export drive

- How to price their exports – for growth, for covering their fixed costs, or for competitive profit.

Ensure companies are proficient in export procedures, introducing them to export groups, freight forwarders, export agents, customs and logistics experts; help companies to find international buyers, agents or distributors. Wherever possible, apply sustainability e.g. packaging demand and needs, go green! In the EU new laws are soon implemented, is your industry ready?

7. Reformulate Business, Industry, Employment and Innovation Policies. Enlightened and fleet-footed governments will use this opportunity to redesign their economies, and Graeme Keay, the policy specialist at GDP Global, knows that many governments will be doing exactly that right now. This is certainly the right time to push through significant policy change. Examples will be to do what is needed to stimulate not only an enterprise economy but also an innovation economy that is not dependent on multinational business and/or commodity exports.

FDI is fine, of course. However, when FDI dominates an economy, this is risky and undesirable, especially in times of global uncertainty. Timely government intervention now can stimulate close collaboration between universities, technical institutes and innovative business.

At home, in a bid to get the country on a new economic growth path, your government should be creating or reviewing industrial policy, the need to subsidise or support certain sectors, options to open up other sectors to painful but needed privatisation, labour policy including more flexible employment arrangements whilst enhancing working conditions and social benefits. Consider the importance of your country’s enterprise economy. What can be done to stimulate SME start-up and growth? Consider all possible measure to stimulate flexible working and jobs in the so-called gig economy. Are the costs of start-up and operation as a sole trader or SME at a best practice competitive level? Or do government regulations, red tape and taxation need to be radically overhauled?

8. Stimulate the Economy with New Trade Policies. International trade should also be a major plank of your new set of government policies and strategies. This may be a big ask for some countries but the ambition should be there.

GDP Global’s trade expert Leon Marais recommends a root and branch review of international trade agreements. Governments should view the present situation and the resultant global recession in a positive light. It’s similar to what happened with the rebuilding of economies and world trade after the Second World War. The cooperation between international organizations will lead to new opportunities. Inevitably, trade patterns are going to change; global trade will not remain the same.

And then there is your country’s customs tariff to consider. Close collaboration with local businesses is an essential starting point. Leon reminds governments that the Customs Tariff is a trade policy instrument. The two main uses of The Harmonized Commodity Description and Coding System (HS) and HS based tariffs are to support local industry – through the reduction of duties on products that are not available locally – or through the increase in customs duty rates on products that are not available locally. Tariffs are also statistical instruments. Many industries will have to be reviewed and the customs tariff policies of many countries or economic or customs unions will have to be reviewed. This granular analysis of thousands of goods and merchandise will be achieved by ensuring that goods are classified correctly. If required, governments should create additional subheadings beyond the international 6 digit subheadings. In exceptional circumstances, trade remedies may also need to be imposed. Expert advice may be needed to investigate alternative measures to assist governments to utilize their Customs Tariffs to assist their economies to become more competitive.

9. Look After your Nation and Regional Brand. Last but by no means least, nurture the sense of national pride in the economy and the positive perceptions of your region abroad. To achieve this, make sure that your country’s international and economic aspirations permeate every aspect of your agency’s priorities and how your organisation goes about its work. At home, put party politics and personal tendencies to one side; instead, focus your energies on the nation’s challenges. Show leadership in your organisation in applauding effort and success. Encourage the new generation of citizens with engagement in modern, attractive and sustainable jobs – even in creating their own businesses. Be open and transparent about failings and limitations in government actions. Stimulate business to take the necessary risks – be kind and supportive to business entrepreneurs who fail on their way to success. Overseas, find out what nations and business think of your homeland. Show that your county thrives on tenacity and has a determination to improve and to become a more admired nation. Of course, emphasise the qualities of your nation’s products and services through nation branding campaigns, export marketing and promotion.

Summary

Our economics team at GDP Global will continue to watch and provide updates on the global economic situation. Contact us for regular economic updates and how IPAs and other promotional bodies should be responding to this unprecedented economic crisis. Also for ideas and solutions on investment and trade promotion this year and also related training for you and your organisation.

GDP Global, 14 August 2020